This article is the second in a four-part series introducing CCG’s new modelling suite for energy finance planning. Here, Luke Hatton introduces FINCoRE (Financing Costs for Renewables Estimator). It can be used to estimate the cost of capital for key technologies used in LMICs and thereby provide more accurate projections. Luke discusses the background, aims and functionality of the tool which was built by a team at Imperial College London.

Background

Energy system models (ESMs) are widely used by stakeholders in academia, industry and governments to explore transition scenarios for national, regional and global energy systems. The use of ESMs is an essential step in CCG’s Data-to-Deal approach being used to support countries along the entire process of developing a credible, feasible and investable energy transition plan.

The cost of capital – the average financing costs from debt and equity investors – is a key parameter for the accurate economic modelling of energy projects. For clean technologies such as wind and solar power – which typically consist of high upfront investments with low operating costs – the project’s economic viability is highly sensitive to the assumed cost of capital. Accurate assumptions for the cost of capital are therefore key to ensuring the utility of technical insights from ESMs.

Unfortunately, empirical data is often limited, outdated and challenging to find. What data is available is typically from high income countries, where clean technologies and their regulation are more established. In lower income countries, the cost of capital can be up to three times higher, according to data from the IEA’s Cost of Capital Observatory. Standard assumptions for the cost of capital are therefore often used to fill gaps in empirical data, but this affects the accuracy of the projections of course.

FINCoRE aims to address this issue. It provides an open-source, easily accessible methodology that can be used to estimate the cost of capital for ten individual technologies at a country level with a yearly granularity. It covers 176 countries, where data is available, and provides fifteen years of estimates at the time of writing, including short term projections up to 2030.

The ten electricity generation technologies covered by FINCoRE at the time of writing were selected due to their roles in energy transition scenarios: 1) Solar PV, 2) Onshore Wind, 3) Offshore Wind, 4) Biomass, 5) Geothermal, 6) Hydroelectric, 7) Tidal, 8) Wave, 9) Combined Cycle Gas Turbines (CCGT) and 10) CCGTs equipped with carbon capture and storage.

What FINCoRE does and why it matters

Alongside the Python model used for FINCoRE, CCG have developed an interactive webtool interface to make it easier to use and more accessible. It provides the following key functionalities to visualise and explore cost of capital estimates at a technology and country level:

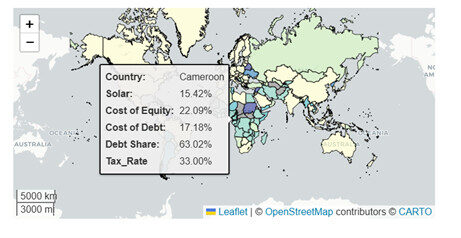

Map: a global heatmap of the cost of capital for a given technology and year, which also provides a breakdown of the cost of equity, cost of debt and the share of the two at a national level. An example is included for solar power in 2024:

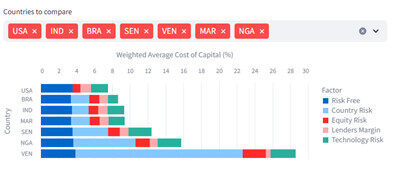

Global Estimates: which allows for a comparison of the cost of capital and the individual factors contributing to the cost across selected countries and for a given year. An example is included for solar power in 2024 (left)

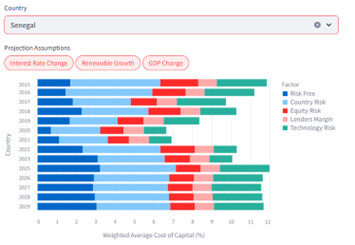

Country Projections: which provides short term projections of the cost of capital to 2030, based on how interest rates and other macroeconomic factors are likely to evolve with time. See left for solar power in Senegal

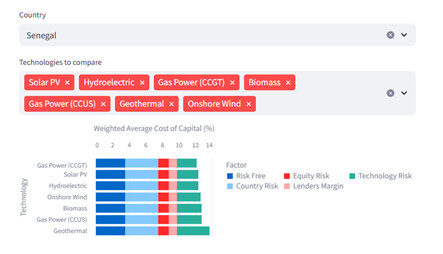

Technology Comparison: which allows for a comparison of the cost of capital across different technologies for a given country and year. An example for Senegal is included for 2024 (left)

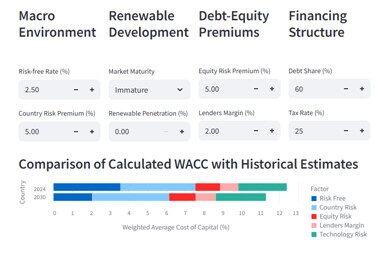

Calculator: an easily accessible version of the underlying model that allows for web-based modification of the input parameters for a given country to calculate the cost of capital.

Integration with other CCG Tools

FINCoRE can be integrated with other tools in Climate Compatible Growth’s suite of Energy Modelling Tools in many ways. Here are just three:

- OSeMOSYS: is used to perform long-term energy system planning and investment optimisation, by determining the most cost-effective system configuration over a set time period. To do this, it requires a range of input assumptions, provided in the Starter Data Kits, though typically a uniform assumption is used for the cost of capital due to data limitations. Estimated costs of capital from FINCoRE could be used to improve the input assumptions used for energy system modelling.

- FINPLAN: created by IAEA, can be used for the financial assessment of power generation projects at a project level. It calculates projected cash flows, financial rations and internal rates of return and is informed by factors such as plant size, investment costs and the cost of capital. Estimated costs of capital from FINCoRE could be used to assess how project viability changes in different countries and years.

- MINFin: (Model for Informed National Financing) is a new tool developed by CCG to explore how decarbonisation pathways in LMICs can be financed. MINFin requires historical and forward-looking data on the cost of capital for clean technologies as an input, which can be challenging or time-consuming to obtain. Estimated costs of capital from FinCoRE can be used to address data gaps, enabling more accurate assessments of the financial viability of decarbonisation strategies.

Try It Out

To support wider adoption, FinCoRE is available as an interactive webtool hosted on Streamlit, accompanied by a free online course through OpenLearn. The course provides guided instruction on how to use and adapt the model to different contexts, making it accessible to planners, analysts, and policymakers alike.

Use the model: https://wacc-forecaster.streamlit.app/ Download the course: https://www.open.edu/openlearncreate/course/view.php?id=14218