In the week when Russian gas ceased to flow into Europe via Ukrainian transit routes, a new paper in Nature Communications explored future prospects for Russian gas exports given a near complete shutdown of the European market, which in 2021, accounted for 66% of its pipeline exports. We talk to Steve Pye to find out more about the inspiration for the paper, the experience of working with a new team and the implications of the work for other stakeholders.

What was the origin of this paper?

“We wanted to test a new approach in which the modelling expertise at UCL was borught together with the geopolitical perspectives of economic geographers, led by Mike Bradshaw at Warwick. The energy crisis that developed largely as a result of Russia’s invasion of Ukraine provided a suitable opportunity.” The research was funded by UK Energy Research Centre (UKERC), with additional support from CCG and the Horizon Europe DIAMOND project. It was undertaken by an interdisciplinary team from UCL Energy Institute, UCL Institute for Sustainable Resources, University of Warwick – Warwick Business School and Oxford Institute for Energy Studies.

What was your overall approach?

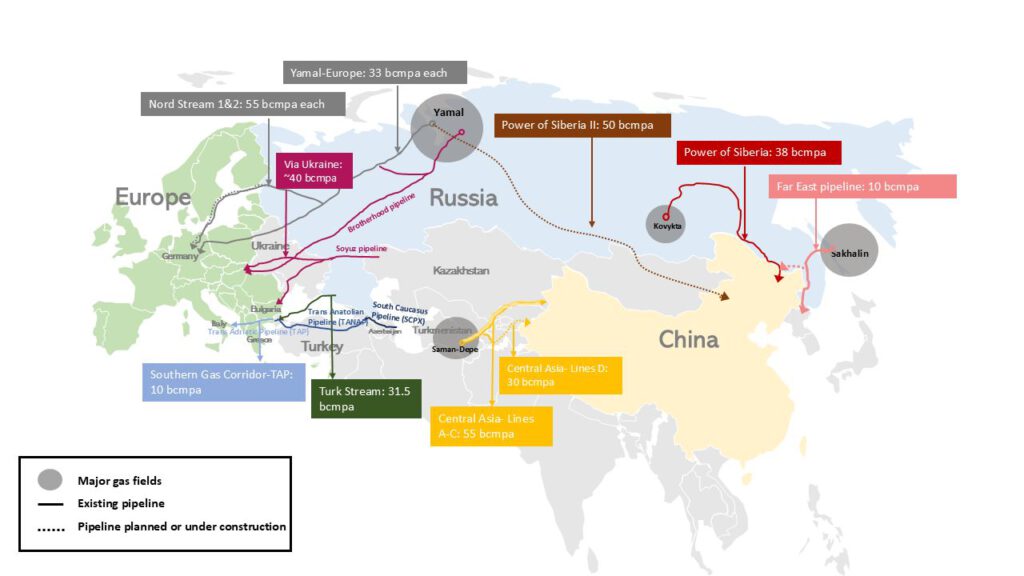

“Two key scenarios were considered: one with Limited Markets and one with a pivot to Asia. Under Limited Markets, Russia struggles to gain new markets via LNG routes and new pipeline capacity, while under Pivot to Asia, Russia sees more export success by expanding pipeline capacity to China, and via a more rapid scaling of LNG. Both scenarios are considered under relatively lower and higher future global gas demand, driven in large part by climate policy ambition. Often the social scientists develop these narratives of energy geopolitics and global gas security, but do not quantify the implications. In this project, these scenario narratives were modelled to better understand the implications of geopolitics on future gas production and trade. Fostering this interdisciplinarity was a key point of our project, and we were really happy with the quality and value of the research produced.”

What were the benefits of working alongside a team specialising in GeoPolitical analysis?

“It was a fascinating experience for me and made me feel that this joint approach should be done more in future. Often, we model future scenarios in something of an idealised way with reference to a country’s ambitions, natural resources and current energy usage data, and typically focus on a somewhat longer-term view. Including our GeoPolitical colleagues brought a ‘real world’ element to the analysis, based on their expertise and knowledge of what is currently happening in respect of regional and global gas trade, and associated political factors driving this. Factors such as conflict have a very real impact on markets and trading agreements linked to political allegiances of other countries so they can’t be ignored.”

What were the key findings of the paper?

The research finds that Russia struggles to regain pre-crisis gas export levels across a range of futures. Compared to 2020, Russia’s gas exports are down by 31–47% in 2040 with the Limited (new) Markets scenario, and down by 13–38% under a Pivot to Asia strategy. A higher demand from China does not significantly improve prospects for Russia. Crucially, any future pivot to Asia is contingent on Chinese energy security and climate mitigation strategy and objectives which are unknown currently. In fact, the future implications of this significant geopolitical shock to gas trade are subject to significant uncertainty and will depend on Russia’s strategy to regain markets for its gas exports. Europe’s push towards increased liquified natural gas (LNG) and the pace of its low carbon transition will also be a factor, as will China’s gas demand and how it balances its climate.

Tell us a little more about the model and data you used.

We used the TIAM-UCL Integrated Assessment Model which has been around since 2010 and is well-established. All the data we needed was readily available given our focus on the oil and gas sector, but we spent a fair bit of time developing the detail of gas resources and trade. Really the key addition to the modelling was the expertise and knowledge of our colleagues from UKERC.

Who would you like to read the paper now it’s available?

I think the findings and their implications will be of interest to a wide range of colleagues in the energy sector as well as policy makers and political strategists perhaps. I think it will also be useful to other modellers about approaches to integrating geopolitics, and for those researching geopolitics to see how models can be applied to better understand implications.

Thanks for talking to us, Steve. The open access paper can be found here – https://rdcu.be/d5p5b.

Yacob Mulugetta adds: Personally, I found the paper very interesting. It made me wonder if Russia’s gas exports remain low for the foreseeable future, what it might mean for European prices and the possible political implications of energy crises. And as the politics of countries pivot to the right, will countries go to pre-conflict levels or can this pivot to China be maintained given new pipelines are coming to life?

The announcement of the paper in Steve’s LinkedIn post has already provoked a lot of response including from Davron Sharipov who said “One of the most riveting things for me in the article is mentioning the upcoming Central Asia Pipeline D 30 bcm/year and the existing Central Asia A C 55 bcm/year and the graphical map is excellent. Kudos to it. Keep it up. There is a lot to explore further.”

Clearly, this is a very far-reaching piece of work that will continue to provoke a response and perhaps change the way things are done in several different fields.